Sale!

ITIN For Non-Residents

$1,100.00 $495.00 GST

Inclusions:

- Accurate preparation of W-7 (Application for ITIN).

- Certificate of Accuracy (COA) endorsed by Koshika LLC.

- Same day application processing.

- Submission of W-7 to IRS through priority Fedex.

- Guaranteed approval or resubmission until approved.

Category: ITIN

You may also like…

-

US Business Checking Account

$1,299.00$199.00 -

Employer Identification Number (EIN)

$499.00$99.00 GST -

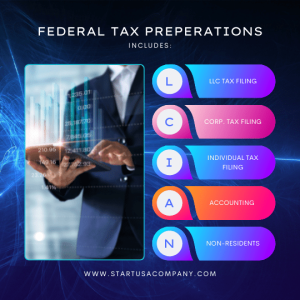

Federal Tax Preparation (Subscription)

$1,200.00$300.00